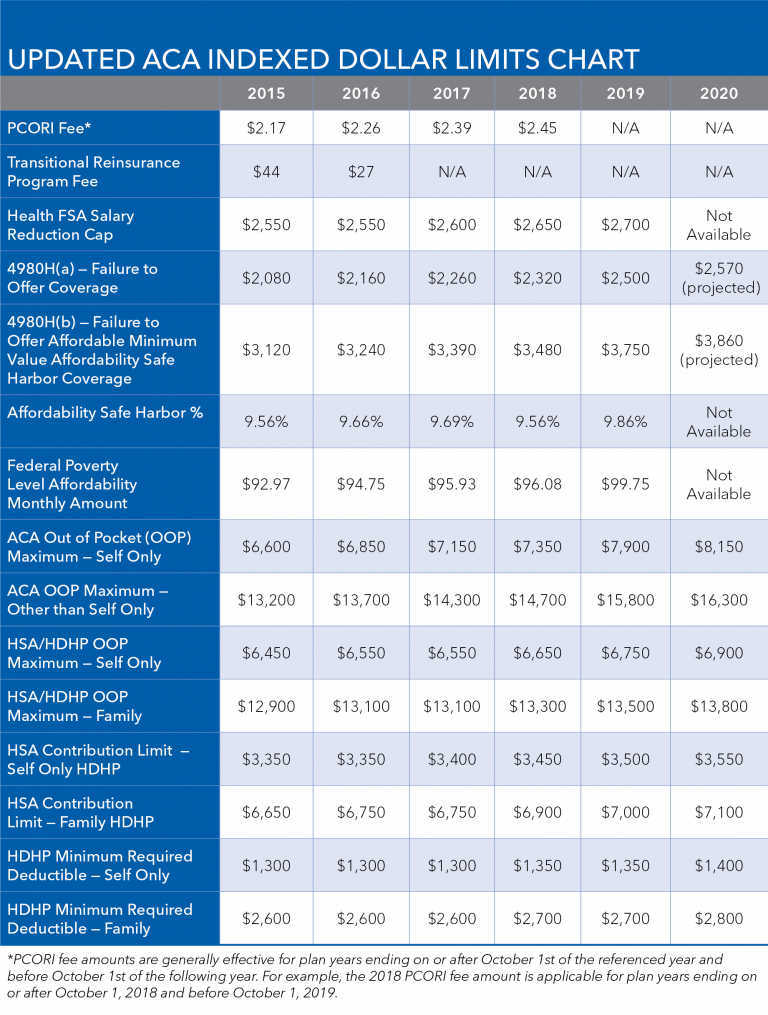

Calculating Aca Affordability 2025. The irs released rev proc. Last year, the irs announced a big change to the patient protection and affordable care act (aca) affordability percentage for 2025.

The irs released rev proc. This is a decrease from 2025 (9.12%) and continues a downward trend in affordability for ptc coverage.

Review the 2025 aca affordability percentage to determine liability for employer shared responsibility payments.

Employer sponsored health coverage for a 2025 calendar plan year will be considered affordable if the employee.

Aca 2025 Affordability Ashil Calypso, The internal revenue service (irs) has announced the 2025 indexing adjustment for the percentage used under the affordability safe harbors under the affordable care act (aca) for plan years beginning in 2025. The internal revenue service (irs) announced an updated new aca affordability threshold of 8.39% of an employee’s household income for 2025 for applicable large employers.

How do you calculate ACA affordability? YouTube, Review the 2025 aca affordability percentage to determine liability for employer shared responsibility payments. The irs released rev proc.

S2Ep42 ACA Affordability 2025 Percentage Comply on the Fly with M3 & Karen B., The health insurance marketplace calculator, updated with 2025 premium data, provides estimates of health insurance premiums and subsidies for people purchasing insurance on their own. The irs has set the new affordable care act (aca) affordability percentage to an unprecedented low 8.39% for 2025.

The Ultra Low 2025 ACA Affordability Percentage, For the 2025 plan year, affordability is defined as the cost of coverage being less than 8.39% of an employee’s household income. To calculate aca affordability for the 2025 tax year using the rate of pay safe harbor and hourly workers’ earnings, take the employee’s lowest hourly rate as of the first day of the coverage period.

IRS Announces 2025 ACA Affordability Indexed Amount — Schulman Insurance, Calculating the “affordability” of employees’ health plans under the affordable care act (aca) is arguably one of the most challenging components of compliance for applicable. Last year, the irs announced a big change to the patient protection and affordable care act (aca) affordability percentage for 2025.

ACAwise's ACA Affordability Calculator YouTube, Employer sponsored health coverage for a 2025 calendar plan year will be considered affordable if the employee. The irs recently announced a significant decrease in the affordability percentage to 8.39% for 2025 under the aca's pay or play rules.

IRS 2025 ACA Affordability Threshold Announcement YouTube, To calculate aca affordability for the 2025 tax year using the rate of pay safe harbor and hourly workers’ earnings, take the employee’s lowest hourly rate as of the first day of the coverage period. Family coverage affordability (10/14/2025 update) as a result of the irs’ updates released last week in rev.

ACA Marketplace and Employer Health Plan Cost Comparison Millennium Medical Solutions Inc., The irs recently announced a significant decrease in the affordability percentage to 8.39% for 2025 under the aca's pay or play rules. The internal revenue service (irs) has announced the 2025 indexing adjustment for the percentage used under the affordability safe harbors under the affordable care act (aca) for plan years beginning in 2025.

Aca Affordability 2025 Fpl Kathe Tallia, Calculating the “affordability” of employees’ health plans under the affordable care act (aca) is arguably one of the most challenging components of compliance for applicable. What is the 2025 aca affordability rate?

2025 ACA Affordability Percentages Announced (and why benefits pros should be paying attention, Calculating the “affordability” of employees’ health plans under the affordable care act (aca) is arguably one of the most challenging components of compliance for applicable. The internal revenue service (irs) announced an updated new aca affordability threshold of 8.39% of an employee’s household income for 2025 for applicable large employers.

Acawise has created the free calculators to help employers and tpas for simplifying the aca compliance process.